Best Channel Vendors 2015 Places Spotlight On Where Vendors Should Focus

By The Business Solutions Network

The January 2015 issue of Business Solutions contains the results of our most recent Best Channel Vendors survey. For the seventh year, we had a great response from our VAR, ISV, and MSP readers. Nearly 3,000 people participated by casting votes on the favorite vendors. Aside from deciding the winners of the survey, the data also tells some other stories.

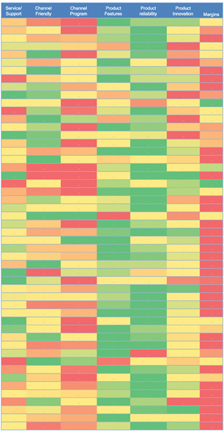

I’ve performed additional data analysis for the past three years to identify overall trends in scoring categories. This year, the results are equally as telling (see the accompanying figure). Voting categories are split into columns (service/support, channel friendly, channel program, product features, product reliability, product innovation, margins). The scores for each vendor (reading across) are color coded. The highest scores (good) are dark green and the lowest (poor) are red. Scores in between fall into a shade of green or a shade of orange.

In looking at chart as a whole, you can see that the lowest scores (i.e. red and dark orange coloring) fall in the categories of channel program (third column from the left) and margins (last column on the right). This is the third year for this trend.

Last year I posited that solutions providers will always want higher margins and that may very well be true. Still, it’s worth noting that not every winner scored lowest in that category. No, some of the winners actually have their highest scores there. Additionally, just like last year, the vendors whose highest scores were in the category of margins were managed services vendors. Not only does this show that there’s money to be made in managed services, since we saw this same thing in last year's data, I feel confident in saying that managed services isn't a shrinking opportunity like you'll find with pure hardware and software sales.

As mentioned, the other low category is channel program. This is really intriguing to me since I know many vendors spend months, if not years, honing their partner programs Indeed, many have entire teams dedicated to their partner program. Understand, this data doesn’t indicate that partner programs are failing (remember, these are just the lowest scores of all the winners), but if I was a vendor, I’d be reaching out to my partners to find out how I could improve things with my partner program.

Every year we do this survey, vendors contact us to learn how they compared to other vendors. We don't release that information. However, for the third year straight, I've released this data, which should place a spotlight on where vendors should focus. We'll see if next year's results show any improvement.