Niche Market, Major Opportunity

By Matt Pillar, Business Solutions magazine

POS resellers are foolish to overlook ethnic grocery stores; their numbers have exploded with Asian/Hispanic population growth, and they’re buying lots of technology.

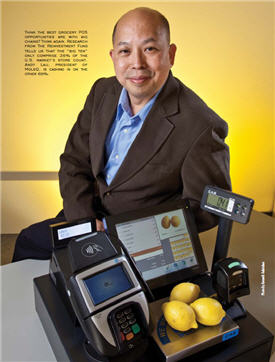

Back in November 2012, we published a story titled Retail IT VARs: Stop Writing Your Business Eulogy, which outlined growing industries for POS resale opportunities and the hot new technologies those industries are demanding. Not long after that story published, we met Andy Lau, president of a New York City POS software and integration company called MoleQ. The subsequent conversations we had with Lau corroborated an assertion we made in that December report; independent grocery — even more specifically, ethnic grocery — is a very promising segment for long-term POS resale growth. If selling to small, ethnic grocery chains doesn’t sound sexy enough for you, consider that IBIS projects the $26 billion market to hit $31.2 billion by 2016. Riding nearly 4% annual growth, the firm projects the opening of nearly 4,000 new ethnic grocery stores over the next four years, bringing the total to more than 25,000. Almost all of them will focus on Asian and Hispanic foods, meeting the demand of the two fastest-growing population segments in the U.S., each having grown more than 40% over the past 10 years according to the Census. In fact, Asian and Hispanic grocery stores own 98.3% of U.S. ethnic grocery sales.

But, don’t place your bets on leading research and Census Bureau figures. Instead, take it from Andy Lau. “Ethnic grocery stores are booming as the Asian and Hispanic populations explode,” he says. Lau has been riding that boom since he and his partners founded MoleQ in 2001, racking up annual sales of nearly $3 million along the way—in the New York City market alone. Here’s some advice from Lau to POS resellers interested in jumping on the ethnic grocery bandwagon.

Overcome The Culture Barrier

Lau will be the first to admit that he’s got a leg up on his competition. He’s an immigrant from Hong Kong. English is his second language. In New York City, where the Asian population is growing faster than anywhere else in the country, it helps that he speaks the native tongue of much of his customer base. But when it comes to selling technology, Lau says there’s more to overcoming the culture barrier than simply speaking the same language. The technology you sell, he says, creates a common denominator. The software Lau sells is homegrown; Lau and his partner, Kevin Tan, built the MoleQ POS system from scratch, with his specific end user in mind. And, while ease of use as a selling point sounds cliché, Lau says it’s absolutely central to the sale in ethnic grocery. “In this business, cashiers come to the position with little or no experience,” he says. “They’re not typically familiar with technology, and neither are the storeowners. It’s very important that the software interface you pitch to them is easy to use. If they don’t understand the features and functions within ten minutes, you’re not likely to make the sale.” To that end, Lau says a touch screen interface that’s heavy on graphics and sales function icons — but as light as possible on language — is key to ethnic grocery POS sales. The MoleQ POS System, for instance, supports upwards of 100,000 picture files that can be associated with specific items upon their entry into the store’s inventory system for lookup purposes, and intuitive icons depict sales operations. With this feature, the solution Lau sells has been quick to displace programmable keyboard-based grocery POS systems, which require considerably longer training of associates. The small amount of language the user interface does require is offered in Chinese, English, Japanese, Korean, or Spanish.

Lau warns resellers interested in the segment that even once the culture barrier has been scaled, they’re not out of the woods. Because of the aforementioned boom in the ethnic grocery market, as much as 20% of the POS systems MoleQ sells are sold to brand new start-up companies. “The first 6 to 12 months is very tough for these new business owners,” he says. “They’re building from the ground up without access to much credit. To win their long-term business, we have to be in a position to help them get started, then help them realize success by making the technology part trouble-free.”

Demand For Sales, LP Reporting Met Through Tech Integration

Lau says more than 90% of his new business is referralbased. More often than not, those referrals are driven by business owners that use MoleQ telling their colleagues about the reporting features that give them better insight into their business. Some of the reporting that excites small business owners is simple. At new item setup, for instance, the storeowner can request to receive a text if sales of that item pass a predetermined threshold in a given amount of time. Other reporting features are achieved through slightly more complex points of integration.

“These small business owners are constantly looking for the small details that give them a competitive advantage. Because even the simplest POS interface is still operated by a human, it’s an error-prone function of the business,” says Lau. By integrating CAS megapixel IP cameras and DVRs with the POS, MoleQ gives storeowners an opportunity to monitor POS activity and receive text alerts when transaction anomalies occur. Lau is quick to point out that his company doesn’t get sidetracked with the physical installation of security cameras and cabling. “We develop, sell, and integrate POS and other retail software systems, and we want to stay focused on that. We use a partner company to handle the physical installation of security and traffic-counting systems,” he says. Integration of weigh scales at customers’ deli, seafood, and meat counters is also key to the LP/reporting aspect of the sale. MoleQ integrates its POS systems directly to CAS weigh scales, helping retailers charge more accurately for fresh and prepared foods, minimizing perishables shrink, and enabling reporting on fresh food sales that feeds directly into the customer’s purchasing and inventory management systems. An astounding 80% of MoleQ customers take advantage of the reseller’s integrated security and weigh scale offerings to gain better control of their businesses. “Small business owners have many small tasks to handle. They can sometimes miss big opportunities to improve their businesses,” says Lau.

With a straight face that assures he’s not joking, Lau relays the story of a customer support visit he made when the owner of an eight-store grocery chain complained about his difficulty navigating the MoleQ interface. “Many successful business owners in this segment don’t know too much about computers,” says Lau. “That was certainly true in this case. When I asked him to show me the problem he was having, I realized he was holding the mouse upside-down.” The anecdote makes clear the key to success in the segment. “These storeowners don’t know technology, but they love their reports, and they know how to use the data,” Lau concludes. “It’s important to demonstrate how technology makes it easy for them to stay connected to the store, to see those opportunities, and to take advantage of them.”

Mobile POS Blossoms Among Independents

Business Solutions hasn’t been shy in its coverage of the channel’s mobile POS play. While some major POS manufacturers seem intent to move mobile POS to DYI commodity status, Lau sees nothing but mobile POS sales opportunity among his ethnic grocery customers. While some trendy independents might relish the opportunity to build their own mobile retail systems infrastructures, Lau says the not-so-tech-savvy storeowners in the niche he serves are looking for all the mobile POS help they can get. Many of his customers had been using Windows CE wireless handhelds for inventory and receiving functions, but he says iOS and Android devices are displacing those. Between the two, Lau is banking on Android. Early in 2012, MoleQ partnered with Casio and PAX on the development of a mobile POS solution. The MG-POS app from MoleQ runs on the Casio VR-100 Android POS terminal and integrates with SP30 and MT30 payment terminals from PAX.

“We offer our mobile POS on the Android platform because we consider it a more scalable hardware option than what’s offered by Apple and a more creative application environment than what we’ve seen from Windows,” he says. “Our customers are using them for line busting, typically buying one or two devices and deploying them when the fixed POS lanes get busy.”

Lau and his team at MoleQ are riding the thriving ethnocentric food retailing market to 20% yearover- year sales growth, and Lau says 2013 could even bring the development of a resale channel for its own software products. According to analysts, ethnic grocery market conditions are expected to see consistent and substantial improvement over the course of the next five years, resulting in an increase in capital investments by business owners in the segment. IBIS research predicts security, POS, and inventory control systems will lead those investments, which puts MoleQ on the path to sustainable long-term growth.