Payment Processing Market Braces For Major Changes

By Brian Albright, Business Solutions Magazine

POS VARs should be prepared to support EMV and mobile payment solutions.

Point of sale (POS) resellers face two major technology trends that will affect their businesses significantly over the next few years. First, the adoption of mobile payment solutions is spreading steadily. Second, merchants will need to prepare to support the EMV (Europay, MasterCard, Visa) standard for IC (integrated circuit) or chip-and-PIN credit cards.

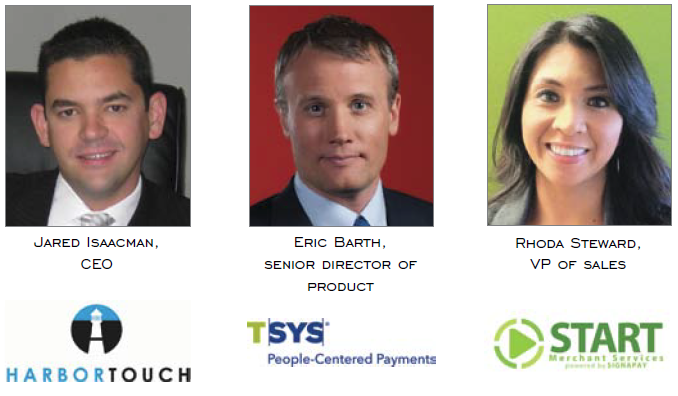

There are also new opportunities for VARs. As prices have dropped, touch screen POS solutions have trickled down to smaller merchants, opening up new markets. “There are more affordable options, and we’re seeing less-traditional markets pick up on some of the benefits of these systems,” says Jared Isaacman, CEO of Harbortouch.

The payment processing market also has become more competitive as more vendors have entered the space. Isaacman says, “VARs can get a much more competitive deal in today’s environment than they could five years ago. If you are still working off a several-year-old referral or reseller relationship, it’s pretty safe to say that the deals have gotten better since then.”

Mobile, EMV Arrive

When it comes to EMV, VARs need to start getting educated now (if they haven’t started already) and have discussions with their customers about exactly what it will mean for their hardware and software infrastructure. In 2015, Visa will begin its U.S. liability shift, meaning that for merchants presented with contact chip cards that have not adopted compatible terminals, fraud liability will shift to the merchant’s acquirer. Expect more such policies moving forward.

“Many merchants consider their POS software a major investment, and in order to ensure the software is ready for the future, VARs/ISVs (independent software vendors) now should be devising their EMV strategy in partnership with their preferred payment processors,” says Eric Barth, senior director of product, TSYS Acquiring Solutions. “Securing sensitive data using a multilayered approach is another topic which VARs/ISVs need to have a clear strategy to help their merchant customers reduce PCI (payment card industry) scope, and the VAR/ISV’s processing partner should be their first stop.”

Mobile payment technology will not have as much impact as EMV over the next few years, but adoption is increasing. With all the market uncertainty, VARs can provide consulting services to merchants.

Rhoda Steward, VP of sales at START Merchant Services, a joint venture of SignaPay and Interchange Plus Solutions, says, “Merchants are very aware that mobile payments are on the rise by a consistent advertisement campaign by Google Wallet and Paypal, but are not sure what to do with this information. VARs/ISVs need to prepare a solution that will accept mobile payments or partner with a payment processor that can safely and effectively offer this solution to their clients.”

Mobile technology presents a number of new marketing opportunities for merchants, including targeted marketing via mobile wallet technology. Loyalty programs also can be synchronized with digital wallets, so real-time rewards, balance information, and redemption capabilities will reside in the cloud and on the mobile device.

“Consumers can and will increasingly store gift accounts in mobile and digital wallets and opt to have gift card balances automatically applied to purchases to provide incentives for using their mobile device to pay,” says Jana Franks, VP, integrated payment solutions, First Data. “Consumers can also purchase and manage (e.g. reload) their gift card account from within mobile wallets.” That can have significant ramifications when it comes to the entire POS solution, since the customer will suddenly play a more central role. “Developing a mobile framework [many times] will be more expensive than initially budgeted because of the necessary refactoring of the core system,” says Sean Kiewiet, CIO and CTO at Priority Payment Systems. “It’s typically not just an add-on component.”

The technology is still nascent, and standards are still developing, so VARs will have to carefully watch the market to determine what type of platforms to support. Isaacman says VARs should focus, in the short term, on tackling EMV for their customers. “You really have to look at EMV, because it represents a big shift in how payments are processed,” Isaacman says. “How are the hardware manufacturers going to adapt, and how are the software vendors going to adjust their product to accommodate PIN and encryption methods? That’s a big deal. While mobile payments are still speculative, EMV is as close to definite as possible. You have to prepare for that.”

Customers At Center Of POS Solutions

Tying all of these trends together, merchants are spending a lot of time and money to integrate the various channels that their customers utilize to do business with them. “The issue is many payment products have been developed for merchants, only with little thought given to the merchant’s customer,” Kiewiet says. “In

fact, many legacy systems contemplate the merchant’s customer only in terms of a card swipe and a vanilla paper receipt. Modern payment systems need to create payment options for the consumer, track preferences, deliver a receipt with couponing (micromarketing), crafted branding, etc., to meet this growing trend.”

That’s part of what’s driving mobile technology adoption, even outside of payment applications. Merchants want to win new, repeat customers using geolocation offers, mobile coupons, rewards, and messaging technology. “Many basic couponing/loyalty features that exist in POS systems today are designed to drive repeat business from existing customers,” Franks says. “The key is to find technology partners that can net new customers that the merchant would not otherwise capture.”

Merchants also want more out of their payment processing providers. By partnering with payment processors that have expanded their offerings (often via cloud services) to include ancillary products like fraud scoring, invoicing, tax nexus calculations, and business analytics, VARs can free up development time while adding value to the product. Those value-added services drive differentiation.

More Changes Ahead

Moving forward, another important development for payment processing is the pending settlement of the “fee fixing” lawsuit filed against Visa, MasterCard, and several major banks. Under the reportedly $6 billion deal, retailers will be allowed to charge customers more if they pay with a credit card. Both Walmart and Target oppose the settlement, however.

“The recent announcement that the lawsuit against the card networks and issuers is being settled is an important one for VAR/ISVs,” Barth says. “Part of the settlement will enable retailers to charge more for card transactions or surcharge those transactions. A proactive VAR/ISV should now be evaluating how it can seamlessly support their merchants who desire to exploit this pending rule change.”

The passage of the Durbin Amendment, IRS 6050W, and emerging PCI standards will also have an impact. “Most VARs/ISVs are focused on their core competency and are not immersed in these regulations, like payment processors, so unfortunately VARs/ISVs do not always have the most upto- date information about these regulations,” Steward says.