Retail IT VARs: Stop Writing Your Business Eulogy

By Matt Pillar, Business Solutions Magazine

“Business as usual” is a sure way to destroy your business in 2013. Independent retailers’ 2013 tech spending plans are mobile, multichannel, and growing.

Still singing the post-recession sales blues? Here’s some news that will help you snap out of it. Independent retailers’ sales numbers and store counts are growing, and they’ve got big plans for tech deployment in 2013.

While the number of retail firms in almost every employment size category has declined in recent years, there’s one major exception that’s very important to retail technology resellers. According to recent data from the U.S. Census Bureau, retail establishments with fewer than 5 employees have grown by more than 10,000 since 2007, and firms in this size category have also recorded increases in both revenue and market share that outpace their larger competition.

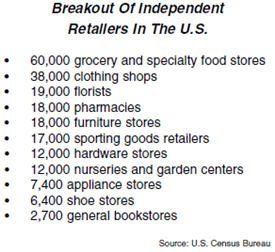

Just how big an opportunity does small and independent retail represent? In addition to better than average sales and market share growth among indies, there are simply a lot of them. More than 210,000, in fact. Consider that more than 95% of U.S. retailers have only one store outlet, and nearly 90% record annual sales under $2.5 million. If you added up all the stores operated by the top 50 retail chains in the U.S., the number of independents would eclipse that store count by more than 25,000.

The good news is that the market is huge and they’re buying technology. The bad news is that they’re buying technology that’s a bit outside the typical POS VAR’s comfort zone. In August and September 2012, Integrated Solutions For Retailers (ISR) magazine surveyed nearly 200 retailers on their 2013 technology spending plans. Small and independent retailers showed up in force, and they made their intentions abundantly clear:

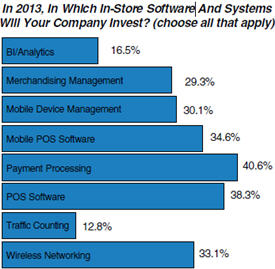

- Store-level mobile devices (i.e. tablets) and mobile applications (i.e. POS) had their strongest showing since the inception of the survey in 2009.

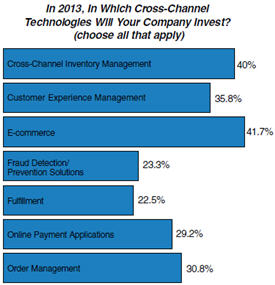

- Retailers are absolutely starving for technology that helps them manage inventory and operate seamlessly across stores and the Web.

- Security solutions remain a leading investment priority.

Got A Problem Selling Mobile? Get Over It.

It’s time for the channel to stop lamenting the mobile revolution. When asked about their in-store hardware investment priorities, 37.9% of retailers in the ISR survey indicated plans to invest in mobile POS next year, leading the category. The percentage of retailers investing in mobile POS hardware will outpace the percentage of those buying traditional (fixed) registers for the first time in 2013. If mobile POS isn’t yet a staple — or at least a new addendum — on your line card, the time is nigh.

True, Apple and Android domination of the tablet and smartphone markets have so far hamstrung the channel’s mobile retail profit opportunity. That’s begun to change, however, with this quarter’s release of Windows 8, its mobile counterpart Windows RT, and Microsoft’s Surface tablet. Now, you’ll have an opportunity to sell an unprecedentedly seamless PC-to-mobile solution that leverages the core Windows OS so many of your customers are accustomed to, and extends it to a bevvy of tablet devices from Microsoft, HP, and others. The other good news for VARs is that data from the ISR report paints a clear picture depicting applications — not devices — as the leading driver of interest in mobility. Even where mobile devices are being adopted for sheer customer and associate appeal — which is the case in an astonishing number of post-Apple-Store retail mobility deployments — application spending soon follows.

In addition to POS, mobile applications for receiving functions, store manager reporting, and even loss prevention incident management led the 2013 software investment interests of retailers in all segments. The takeaway here is to focus your pitch on creating a software subscription and services sales opportunity that extends the value of mobile retail solutions far beyond the peddling of commoditized hardware.

That said, there remains a significant opportunity for some traditional store-level hardware sales. Receipt printer investments, which had previously topped the list of retailers’ in-store hardware priorities every year since the ISR study began, remained strong with 37.1% of retailers planning to invest in them next year. Here again, the devil is in the details. As mobile POS gains market share, retailers won’t be looking for yesterday’s receipt printer. As independent retailers continue to seek technology solutions that put them on par with customers’ expectations set by big national brands, they’ll want you to sell them receipt printers that print in color and integrate with couponing and loyalty applications. This is especially true in independent grocery, where couponing and loyalty applications are thriving.

Ignoring Cross-Channel Integration? You’ve Got A Foot In The Grave.

The channel’s ignorance of retailers’ cross-channel integration needs is a sob story on par with its largely indignant response to mobile retailing. The retail e-commerce momentum that’s taking big bites out of sales opportunities for traditional brick-and-mortar retail technology resellers creates an incredible opportunity for progressive ones. Because retail e-commerce sales are growing at a significantly faster rate than brick-and-mortar retail sales, retailers are begging for cross-channel enabling retail systems, and VARs have to respond.

In Q2 2012, for instance, retail e-commerce sales grew 3.3% year-over-year, compared with a 0.4% drop in total retail sales during the same time period. As such, merchants who sell in stores and online are investing more resources in technology that helps them manage both channels seamlessly, and inventory management applications lead that charge. If you sell brick-and-mortar specific POS or inventory management applications to retailers who transact both in stores and online, you’re ignoring a huge opportunity that will cost your customers when their next POS and inventory management investment cycles come around.

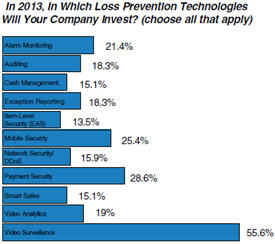

Surveillance Leads Retail LP/Security Needs

While resellers that cater to independent retailers may forever compete with cut-rate Internet pricing on do-it-yourself POS solutions, indies are far less likely to go it alone in the security arena. Increasingly, even small retailers are looking for integration of surveillance systems with their POS plants, as evidenced by the anticipated growth in surveillance system deployments in 2013. The percent of retailers planning to buy surveillance equipment in 2013 climbed nearly 8 points to 55.6%.

Independent retailers know that even off-the-shelf, stand-alone security systems require more networking and server knowledge than they’re likely to possess, making it a VAR’s job to fill the gap.

When you’re pitching video surveillance systems, it’s important to think in interdisciplinary terms. Hardened “security types” who control video surveillance budgets once vehemently protected these investments, but they’re gradually opening up to facilitating access to video data for merchandising and store operations analytics. They’re beginning to realize that by expanding the ROI on video, they also expand the surveillance system budget line by sharing it with other departments. Include the case for merchandising and store operations improvement in your video sales pitch, and be sure that those decision makers have a place at the table.

Where security is concerned, the second-leading priority for retailers in 2013 revolves around payments. The PCI DSS (Payment Card Industry Data Security Standard) — love it or hate it — creates opportunity for consultative resellers who cater to independents, the majority of whom are underinformed on payment security initiatives. With the host of secure, subscription-based payment solutions available to resellers, secure payment applications should be a lucrative source of recurring revenue in 2013.

Final Thought

There’s no growth in the status quo; survival depends on understanding what merchants are buying and adjusting your solutions portfolio accordingly. For retail technology resellers to survive in a quickly evolving industry, change simply isn’t an option.