Retail Tech Sales 2014: It's All About The Consumer

By Matt Pillar, chief editor

Retailers’ 2014 retail technology budgets will be won by solutions providers who understand the new influence of the consumer.

For the past several years, we’ve been chronicling the ongoing success of retail technology resellers and solutions providers who have made the transition from traditional POS hardware sales to enablers of mobile and cross-channel retailing. Demand for mobile and cross-channel infrastructure — the devices and software that enable both the new in-store customer experience expectation and buy anywhere/fulfill anywhere consumerism — has been growing steadily across virtually every segment. Progressive resellers are capitalizing, and these sales opportunities haven’t even peaked yet. Results of the annual Integrated Solutions For Retailers (ISR) Technology Spending Survey point to a clear trend that spells even more good news for future-forward, consultative retail VARs and ISVs (independent software vendors). With the tech infrastructure necessary to enable mobile customer engagement and cross-channel retailing falling into place, retailers are beginning to invest more time and money in the applications that infrastructure will carry and the systems they’ll use to manage them. In short, the hot opportunity to sell devices and networks is opening up an equally hot opportunity to sell applications and expertise.

In August and September 2013, Integrated Solutions For Retailers surveyed its 41,000 strong email newsletter subscriber base on their 2014 technology plans across a variety of disciplines, including:

- In-store hardware and software

- Loss prevention and security

- Cross-channel and supply chain

- Marketing/operations systems.

The insight the survey uncovered provides a veritable roadmap for retail-focused VARs and ISVs. If you want to grow your business, expand your solutions portfolio, or develop a new service, understanding retailers’ planned technology investments is the starting point. Here, we’ve extracted highlights from the survey that we believe will serve the channel well.

In-Store Systems: The Mobile Applications Groundswell

By now, good retail tech solutions providers have figured out how to capitalize on the high demand for mobile devices at the store level. In 2014, great retail tech solutions providers will capitalize on the more profitable network, mobile application, and device management opportunities created by the influx of mobile devices.

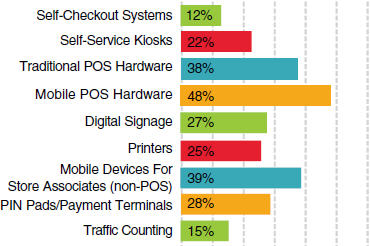

In 2014, What In-Store Hardware Technologies Does Your Company Plan To Invest In?

(choose all that apply)

The race for tablet-based POS has spawned a new breed of VAR, those catering to the nearly 40 percent of retailers who made mobile POS their top in-store hardware spending priority in 2013. That opportunity grows greater still in 2014, when nearly half of retailers will make mobile POS their top in-store hardware expenditure. But mobile hardware deployment is far from limited to the POS. While the desire to conduct mobile transactions remains the primary driver of mobile device sales in retail, nearly 40 percent of retailers plan to invest in non-POS in-store mobile devices next year. To maximize the mobile hardware sales opportunity, resellers must acknowledge that retailers’ intent to adopt customer-facing mobile applications such as CRM, loyalty, clienteling, and mobile marketing creates a sales opportunity nearly as great as mobile POS.

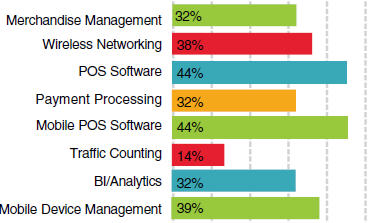

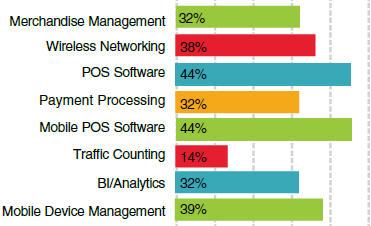

As you might expect — and even more compelling for total mobile solutions providers — is that mobile application spending is growing just as rapidly as mobile hardware spending. While it was a top priority for slightly more than a third of retailers in 2013, 44 percent of retailers indicate mobile POS is their number-one software concern for 2014. Following closely behind are investments in the wireless networks those applications depend on and the mobile device management systems retailers need to protect their investments, which 38 percent and 39 percent of retailers will invest in (respectively) in 2014.

In 2014, What In-Store Software & Systems Technologies Does Your Company Plan To Invest In?

(choose all that apply)

The mobile revolution in retail has long been lamented by hardware margin-obsessed resellers who fear the degradation of profit at the hands of inexpensive devices and, increasingly, cloud-based application delivery. Now, as mobile matures into its own ecosystem of hardware, applications, networks, management systems, and services, that trepidation is fading. Margins lost to inexpensive hardware are more than recouped through application integration and the consultation and services that go with deployment and management of a fleet of mobile devices.

While the hottest opportunities for growth are decidedly tied to mobile, the ISR report provides some good news to those clinging to box-based POS sales: traditional POS hardware and software deployments are still alive and well. Nearly 40 percent of retailers intend to invest in fixed POS terminals next year—presenting a better opportunity than both self-checkout and digital signage/kiosks — and traditional POS software tied mobile POS applications for the top priority heading into 2014. The word of caution here is that for most of the retail market, mobile or fixed is not part of the POS planning discussion — most are investing in both.

While customer-facing technology investments are the most exciting theme in retailers’ 2014 tech spending plans, investment in PCI compliant payment processing solutions remains the most mandatory. Last year, payment processing initiatives topped the in-store software to-do list for 40 percent of our survey, making them the number one priority. While mobile POS software, wireless networks, and mobile device management spending will surpass that of payment processing in 2014, nearly a third of retailers still plan to invest in payment software next year.

Is The CMO In Your Sales Funnel?

The aforementioned non-POS applications that are driving mobile devices into retail are key to the channel player’s success, and a common cliché ties them all together: customer centricity. It’s been a retail buzz phrase for years, but let’s be honest; there was no urgent need to cater to customer demands before mobile Web access and the likes of Amazon gave consumers the power to price match and showroom (whereby shoppers explore their choices in the realm of physical retail before consummating the sale — often at a discount — online). In the pre-mobile past, what happened at the associate-to-consumer level of engagement mattered almost as little to retailers as it did to resellers. How your retail customers executed the customer engagement with or without the aid of your solutions was neither here nor there — the consumer was captive.

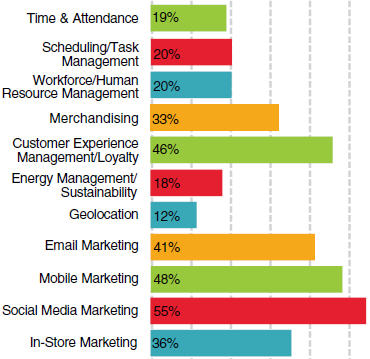

In 2014, What Marketing & Operations Technologies Does Your Company Plan To Invest In?

(choose all that apply)

Today, that couldn’t be further from reality. According to Gartner Research, by 2017 the chief marketing officer will have a larger technology budget than the chief information officer. That’s because consumers are captive no more. The smartphone has become instrumental to shopping activity, customer loyalty (or, for the cynic, customer captivity) has been destroyed, and it’s increasingly the marketer’s job to win customers back. However, some caveats have come with the marketer’s important new role (and big new budget). No more fuzzy math. No more assumed results. The board wants facts — measured key performance indicators (KPIs) — associated with every marketing dollar spent. These well-heeled marketers are depending on you for the technology they’ll use to deploy and monitor their new, tech-based marketing platforms. Let’s look at the numbers.

When asked how they’ll invest in the technology that drives marketing strategy, nearly 55 percent of retailers said social media marketing is the top priority in 2014. If you’re an ISV (or any semblance of an applications developer), consider social integration. The fastest mover in the ISR survey was mobile marketing. Nearly 50 percent said they’d invest there in 2014, up from a third in 2013. Another half will invest in customer experience management/loyalty solutions, which are nothing today if they’re not mobile. Marketing, customer experience management, and loyalty applications are driving mobile hardware sales in retail. And it’s the CMO who’s holding the budget.

When asked how they’ll invest in the technology that drives marketing strategy, nearly 55 percent of retailers said social media marketing is the top priority in 2014. If you’re an ISV (or any semblance of an applications developer), consider social integration. The fastest mover in the ISR survey was mobile marketing. Nearly 50 percent said they’d invest there in 2014, up from a third in 2013. Another half will invest in customer experience management/loyalty solutions, which are nothing today if they’re not mobile. Marketing, customer experience management, and loyalty applications are driving mobile hardware sales in retail. And it’s the CMO who’s holding the budget.

The takeaway here is twofold. First, there’s a massive opportunity for ISVs willing and able to integrate and sell “customer-centric” applications on mobile platforms. Building these alongside core POS offerings is a sound strategy for bigger sales and healthier margins. Second, make sure you’re inviting the CMO to the sales presentation.

Surveillance Continues To Burgeon

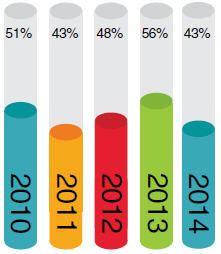

For the past few years, Business Solutions magazine has gone long on the wide-open opportunity for retail technology resellers to make money selling video surveillance solutions. While investment in video surveillance is anticipated to fall from the peak it hit last year, it remains the most important and most-purchased tool in the retail LP professional’s arsenal. As the following chart indicates, surveillance infrastructure has been the top LP/security priority in each of the tech spending surveys ISR has conducted.

Percent of retailers planning to invest in video surveillance applications

Similar to mobile application sales, video surveillance technology sales require a multidisciplinary audience. The planned spending increase on video analytics (up 6.6 percent to more than a quarter) in 2014 is due at least in part to advanced tools such as facial recognition, traffic counting, exception alerts, and traffic/dwell time analysis that empower traditional (LP) users, merchandisers, and marketers alike.

In 2014, What Loss Prevention Technologies Does Your Company Plan To Invest In?

(choose all that apply)

The massive adoption of mobile devices by retailers presents the channel with another opportunity to grab the ear of the LP/security budget holder. Spending on network and mobile security solutions is forecast to climb more than 8 percent and 4 percent, respectively. The responsibility for protecting network infrastructures from DDoS (distributed denial of service) attacks, phishing schemes, and other threats continues to shift toward the LP department as inextricable links are continuously discovered between these risks and ORC (organized retail crime) groups. Data security threats are also contributing to increased payment security spending, as 28 percent of retailers are planning investments here again next year.

Cross-Channel: Reseller Conundrum No More

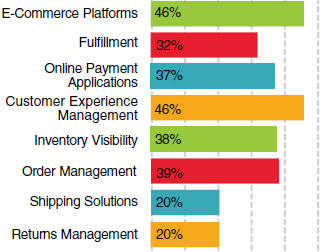

Underscoring the customer centricity theme, retailers will invest as much in cross-channel customer experience management as they will in e-commerce platforms next year — 46 percent for each puts these two initiatives at the top of their cross-channel priority lists.

For resellers, this shift is welcome news. Managing the cross-channel customer experience is all about integration with store systems, which falls smack-dab in the center of your wheelhouse. With that said, where most retailers traditionally forced their e-commerce platforms to “play nice” with store-based POS systems, more cross-channel retailers are flipping that precedent on its ear. Enabling inventory visibility and managing cross-channel orders was a top priority for 40 percent of retailers in 2013, and inventory visibility and order management will remain high priorities in 2014.

For resellers to grab more budget share from integrated cross-channel retailers, adopting a holistic retail systems suite with a cross-channel pedigree should be given serious consideration.

In 2014, What Omni-Channel Retailing Technologies Does Your Company Plan To Invest In?

(choose all that apply)

Payment processing solutions have presented an outstanding reseller opportunity in brick-and-mortar retail for years, and that opportunity parlays into the e-commerce realm. Resellers with payment processing expertise can capitalize, as card-not-present payment solution adoption is up more than 7 percent in terms of budget priority from 2013 to 2014. The 37 percent of retailers planning to invest in secure online payment applications soars over the 2011 figure of less than a quarter.

Conclusion: Customer-Centricity Comes Of Age

In 2013, retailers invested heavily in systems designed to streamline cross-channel operations, rush mobile devices and applications into stores, and secure and manage their inventory assets. VARs and ISVs capitalized on the associated infrastructure requirements, and ISR’s 2014 retail tech spending forecast indicates that opportunity will continue. However, as that infrastructure falls into place, investment intentions are increasingly turning toward customer-centric applications and managed services to support them. That trend spells even more opportunity for the retail solutions channel.