The Verdict Is Out: Why Investment Opportunities Favor The Engineering Software Market

By Tony Christian, Director, Cambashi

Through leveraging our market knowledge, research data, and analysts whom understand the challenges and importance of buying and selling IT to support critical business processes, it would seem that investing in technology companies in recent years has once again become detached from the “fundamentals”; we are back to the casino game of “get in, watch carefully and then try to get out again at a point where the price is higher than you paid.” It’s hard to see what this sort of “hit and run” investing does for the economy — for one thing it drives a damaging misallocation of capital. But there is one area of technology investment that still looks good on the basis of fundamentals and supports the productive areas of the economy — engineering software.

The engineering software market covers the wide range of applications used by engineers and designers in manufacturing, architecture, construction, utilities and other sectors. The engineering software market defines the use of different software such as computer-aided designing (CAD) software, computer-aided engineering (CAE) software, computer-aided manufacturing (CAM) software, product lifecycle management software (PLM), etc. in manufacturing; business intelligence manufacturing (BIM) and related applications in architecture, engineering and construction (AEC); geographic information systems; and even applications like visual effects (VFX) that are increasingly used to visualize designs. With the trend towards “smart devices,” the scope now needs to include the tools used for embedded software development. Taking this scope, the “core” market was around USD 25 billion in 2014.

These types of software applications are utilized across various engineering disciplines, such as electronics and communication engineering, electrical engineering, process engineering, chemical engineering, and mechanical engineering.

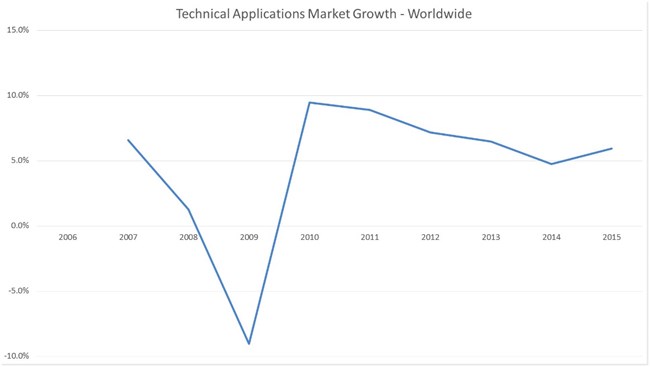

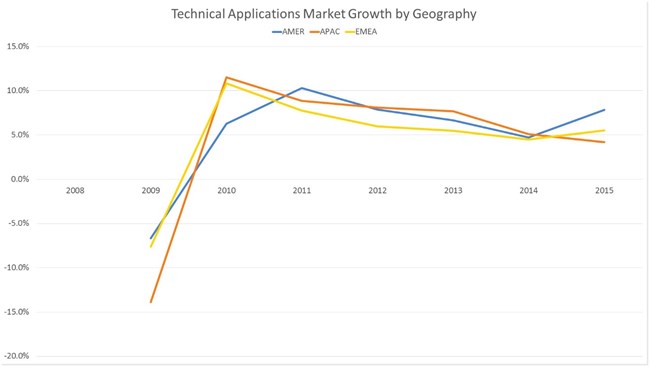

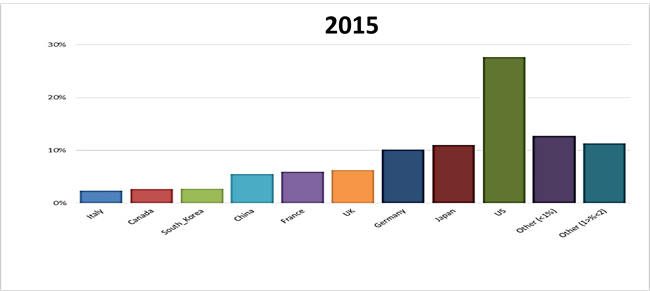

So, what about the fundamentals? Chart 1 tracks worldwide growth. Since a fall in 2009 following the 2008 crash, the market has returned to growth despite the ongoing economic problems. Chart 2 shows the variation by region. Chart 3 shows the distribution of the market by the top 10 countries.

Chart 1 – Overall Market Growth 2006-2015

So from an investment point of view, engineering software has shown great resilience. One reason for this is that there are benefits irrespective of the circumstances of the user organization. They range from reduced costs and streamlined product development processes to better designs, the ability handle more complex products, right up to integrated product lifecycle management. A second reason for continued growth is that engineering software is being adopted in ever-increasing areas of activity. In manufacturing industries, from origins in the product design and development phases of a product’s life, engineering software is being exploited right across the product lifecycle, supporting new ways of providing after-sale maintenance and support and closing the loop between innovation and field use. With the increasing use of smart networks for managing production and even in the design and development phases, it’s being used to support new collaborative approaches and processes. In the architecture, engineering and construction (AEC) industries, the growing use of building information management (BIM) to integrate not only design but also facility operation across its lifetime is generating numerous new application and integration technology opportunities.

Chart 2 – Growth by Region

Chart 3 – Market Distribution by Country

Then there is the question of exit. The engineering software market’s nature, structure and dynamism mean that for the right businesses there are excellent exit opportunities. The major players now primarily seek competitive advantage by breadth of integrated solution portfolio rather than by focused product capabilities; the sheer range and number of the applications required to achieve this makes it impossible for them to develop everything in-house. Consequently, the recent history of the market has featured a string of strategic technology acquisitions by the dominant companies.

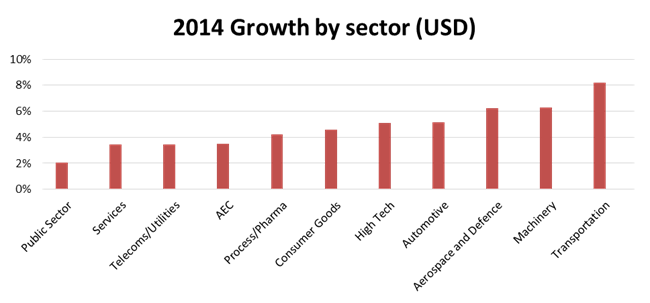

The trick, of course, is to identify the right technologies in the right sectors. The engineering software market is very complex, spanning almost all parts of the world and covering a huge number of industries and a huge number of products for a wide range of activities. Like most markets, it also has its mature areas, where growth is modest but steady and entry is difficult, its growth “hot spots” and its white spaces. Furthermore, many customers have made substantial investments in their engineering software infrastructure, with well-established incumbent product sets supporting their product development workflows. But looking at various perspectives can be very helpful; for example, the chart below shows growth in 2014 by high level industry sector.

So, the combination of market complexity and maturity means that evaluating investment opportunities is a multi-dimensional task, requiring many perspectives. Nevertheless, if done carefully, the investment outcomes in the engineering software market can be very positive.

Investing in the engineering software market was the subject of a recent Cambashi webcast; view the recording at http://www.cambashi.com/webinar

Tony Christian brings to Cambashi wide ranging experience in engineering, manufacturing, energy, and IT. Previously, he was a director of the UK Consulting and Systems Integration Division of Computer Sciences Corporation (CSC), leading a consulting and systems practice for manufacturing industries, and then Services and Technology Director at AVEVA Group plc where he was responsible for all product development and the company's worldwide consulting and managed services business. Tony holds a BSc degree in mechanical engineering and an MSc degree in engineering acoustics, noise, and vibration, from the University of Nottingham